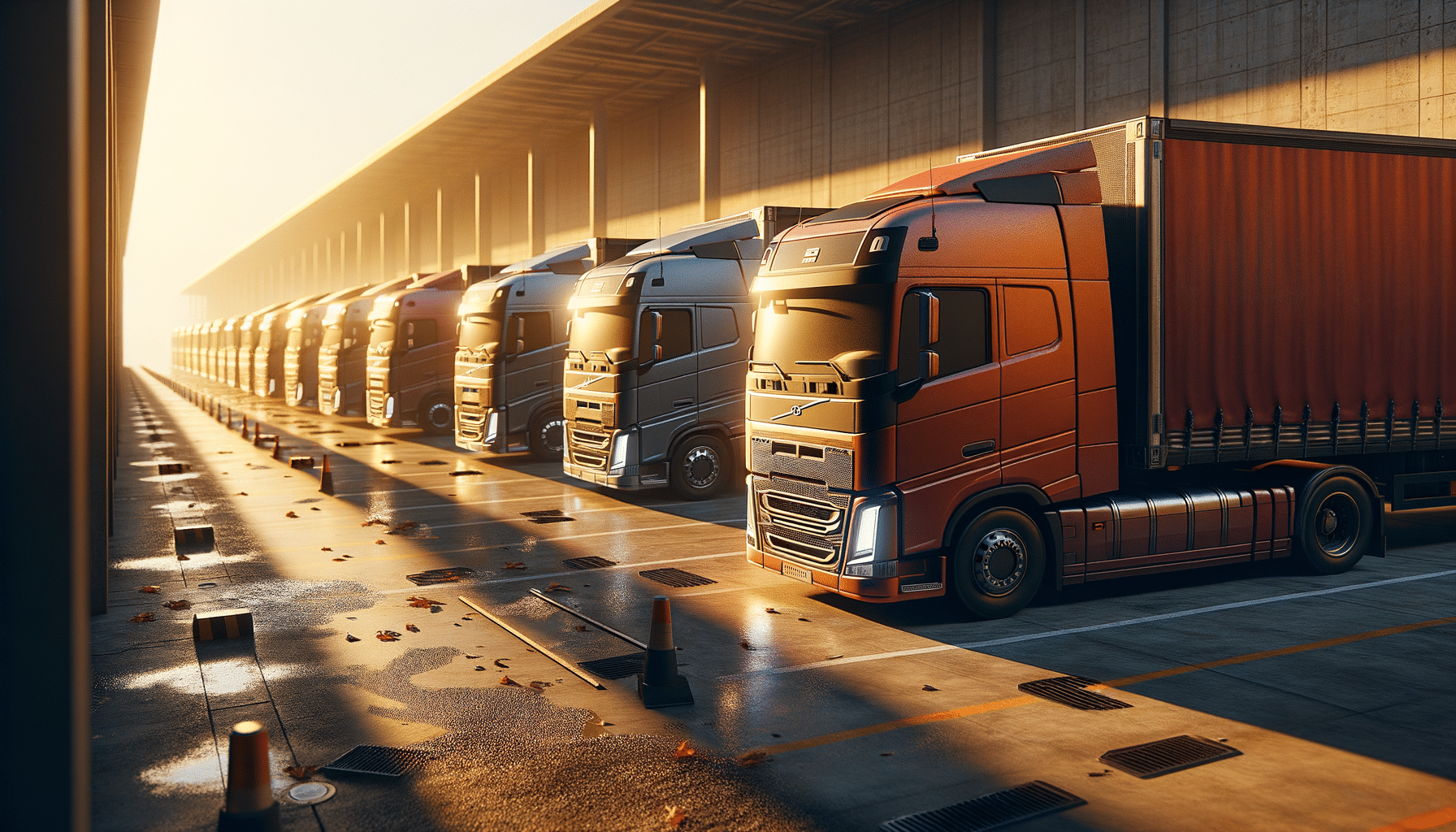

Factoring Companies for Trucking Companies Explained: An Overview

Introduction to Factoring in the Trucking Industry

In the dynamic world of trucking, cash flow can often be a significant challenge. Trucking companies frequently face the dilemma of waiting extended periods to receive payment for their services, while their operational costs—such as fuel, maintenance, and payroll—demand immediate attention. This is where factoring companies for trucking companies come into play. Factoring is a financial transaction where a business sells its accounts receivable to a third party at a discount, providing immediate cash flow. This article delves into the relevance and utility of “factoring companies for trucking companies,” “truck factoring companies,” and “factoring company trucks” in the modern trucking landscape.

Understanding Trucking Factoring Companies

Trucking factoring companies specialize in providing cash flow solutions to trucking businesses by purchasing their invoices at a discount. This service is highly beneficial for trucking companies as it allows them to access funds quickly, without waiting for clients to pay their invoices. The process is straightforward: once a load is delivered, the trucking company submits the invoice to the factoring company. In return, the factoring company advances a significant percentage of the invoice amount, often within 24 to 48 hours, thus easing the cash flow challenges faced by trucking enterprises.

Trucking factoring companies are particularly advantageous for small to medium-sized trucking businesses that may not have the cash reserves to sustain long periods of waiting for payments. By transforming receivables into immediate capital, these companies enable trucking businesses to focus on their core operations and growth strategies without financial strain.

Key Benefits of Factoring for Trucking Companies

Factoring offers several benefits that make it an appealing option for trucking companies:

- Improved Cash Flow: By converting invoices into immediate cash, trucking companies can manage their day-to-day expenses more efficiently.

- Flexibility: Factoring does not require long-term commitments, allowing companies to factor invoices as needed.

- No Debt Incurred: Unlike loans, factoring does not add debt to the company’s balance sheet, preserving financial health.

- Focus on Operations: With financial worries alleviated, trucking companies can concentrate on delivering services and expanding their business.

These advantages make factoring a strategic financial tool, particularly useful for trucking companies aiming to maintain stability in a competitive market.

Choosing the Right Factoring Company

Selecting the appropriate factoring company is crucial for maximizing the benefits of factoring. Here are some considerations for trucking companies:

- Reputation and Experience: Choose a factoring company with a strong track record in the trucking industry.

- Terms and Rates: Understand the terms of the agreement, including fees and advance rates, to ensure they align with your financial strategy.

- Customer Service: A factoring company that offers excellent customer service can provide valuable support and guidance.

- Flexibility: Look for a company that offers flexible terms and does not lock you into long-term contracts.

By carefully evaluating these factors, trucking companies can partner with a factoring company that best meets their financial needs.

Conclusion: The Strategic Role of Factoring in Trucking

In conclusion, factoring companies play a pivotal role in the trucking industry by offering a viable solution to cash flow challenges. They enable trucking companies to receive immediate payment for their services, thus supporting operational stability and growth. By understanding the mechanisms and benefits of factoring, trucking businesses can make informed decisions that enhance their financial health and competitive edge. As the industry continues to evolve, factoring remains a relevant and strategic financial tool for trucking companies aiming to thrive in a demanding market.