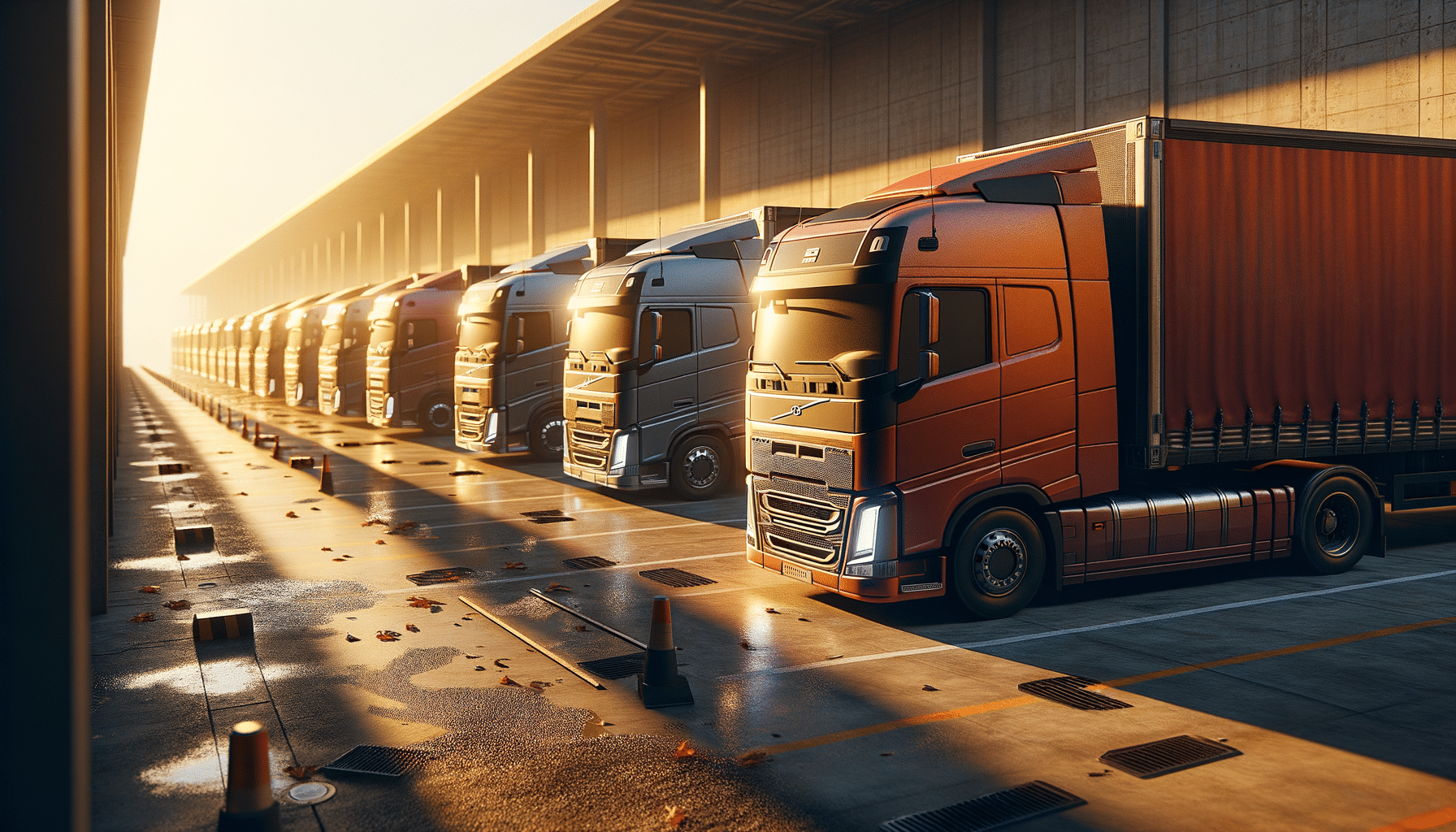

Trucking Invoice Factoring: An Overview

Understanding Trucking Invoice Factoring

Trucking invoice factoring is a financial transaction that involves selling outstanding invoices to a factoring company to receive immediate cash. This process is particularly beneficial for trucking companies that need to maintain a steady cash flow to cover operational costs such as fuel, maintenance, and payroll. By converting accounts receivable into instant capital, businesses can avoid the typical 30 to 90-day waiting period for invoice payments.

While trucking invoice factoring can be a lifeline for companies facing cash flow challenges, it is essential to understand the terms and conditions associated with this financial service. Factoring companies typically charge a fee, which can be a percentage of the total invoice amount. Therefore, it’s crucial for trucking businesses to assess whether the immediate access to funds outweighs the cost of factoring services.

Moreover, trucking invoice factoring can offer additional benefits such as credit checks on potential customers, which can help businesses avoid clients with poor payment histories. This aspect not only aids in maintaining cash flow but also enhances the overall financial health of the company by reducing bad debt.

How Trucking Invoice Factoring Works

The process of trucking invoice factoring is straightforward, yet it involves several key steps. Initially, a trucking company delivers goods to a customer and issues an invoice. Instead of waiting for the customer to pay, the company can sell this invoice to a factoring company.

The factoring company then advances a significant portion of the invoice amount, usually between 70% to 90%, to the trucking company. This advance provides the needed cash flow to keep operations running smoothly. After the customer pays the invoice, the factoring company releases the remaining balance, minus a factoring fee.

This method of financing is particularly advantageous for small to medium-sized trucking companies that may not have access to traditional bank loans. It allows them to manage their cash flow effectively without incurring additional debt. Additionally, it provides businesses with the flexibility to meet unexpected expenses or take advantage of new opportunities.

Advantages of Trucking Invoice Factoring

Trucking invoice factoring offers numerous benefits that can significantly impact a company’s financial stability and growth. One of the primary advantages is the immediate access to cash, which helps in managing daily operational costs without delay. This liquidity is crucial for maintaining fleet operations, paying drivers, and covering other expenses.

Another notable benefit is that it enables businesses to focus on growth rather than chasing payments. By outsourcing the collection of invoices to a factoring company, trucking businesses can allocate more resources and time to expanding their operations and improving customer service.

Furthermore, factoring companies often provide additional services such as managing accounts receivable, conducting credit checks, and offering detailed financial reports. These services can help trucking companies make informed decisions and mitigate risks associated with non-payment by customers.

- Immediate cash flow improvement

- Reduction in administrative burden

- Access to professional credit management services

- Potential for business growth and expansion

Considerations and Challenges in Trucking Invoice Factoring

While trucking invoice factoring presents several advantages, there are also considerations and challenges that businesses should be aware of. One of the primary considerations is the cost involved. Factoring fees can vary, and businesses should evaluate whether the benefits of immediate cash flow outweigh these costs.

Additionally, not all invoices may be eligible for factoring. Factoring companies typically assess the creditworthiness of a trucking company’s customers before agreeing to purchase invoices. This means that businesses with clients who have poor credit histories may face challenges in utilizing factoring services.

Another challenge is the potential dependency on factoring as a primary source of financing. While it can be a useful tool for managing cash flow, relying too heavily on factoring can limit a company’s ability to build its own creditworthiness and financial independence.

- Cost of factoring fees

- Eligibility of invoices

- Potential dependency on factoring

- Impact on customer relationships

Conclusion: Is Trucking Invoice Factoring Right for Your Business?

Trucking invoice factoring is a viable financial solution for many trucking companies, particularly those looking to improve cash flow quickly. It offers immediate access to funds, reduces the administrative burden of managing accounts receivable, and provides valuable credit management services.

However, businesses should carefully assess their financial situation and consider the associated costs and potential challenges. For companies with stable cash flow and strong customer relationships, factoring can be an effective tool for growth and stability. Conversely, businesses heavily reliant on factoring should strive to diversify their financing strategies to ensure long-term financial health.

Ultimately, the decision to use trucking invoice factoring should be aligned with the company’s overall financial goals and operational needs. By evaluating the pros and cons, trucking companies can make informed decisions that support their growth and success in the competitive transportation industry.