International and Overseas Payroll Services: An Overview

Understanding International Payroll Services

In today’s globalized economy, businesses are increasingly operating across borders, necessitating a comprehensive understanding of payroll services international. This term generally refers to the systems and processes that manage employee compensation across different countries. The complexity of these services arises from the need to comply with diverse regulatory requirements, tax laws, and currency exchanges. Companies that expand internationally must navigate these challenges to ensure accurate and timely payroll processing.

International payroll services typically include:

- Compliance with local labor laws and tax regulations.

- Management of multi-currency payrolls.

- Handling of expatriate payrolls and tax equalization.

- Integration with existing HR systems.

These services are crucial for multinational companies as they help mitigate risks associated with non-compliance, which can lead to hefty fines and legal repercussions. Understanding the nuances of international payroll is essential for businesses looking to maintain their global workforce efficiently.

The Role of Technology in Payroll Services

Technology plays a pivotal role in streamlining international payroll services. With advancements in software solutions, companies can automate complex payroll processes, reducing the likelihood of errors and improving efficiency. Cloud-based platforms offer real-time access to payroll data, enabling businesses to make informed decisions quickly.

Key technological advancements include:

- Automated compliance updates to ensure adherence to local laws.

- Integration with global banking systems for seamless transactions.

- Data analytics tools for strategic workforce planning.

- Mobile access for remote management of payroll operations.

These innovations not only enhance accuracy but also provide valuable insights into payroll trends and employee compensation structures. As technology continues to evolve, its impact on international payroll services will likely grow, offering even more sophisticated tools for managing global workforces.

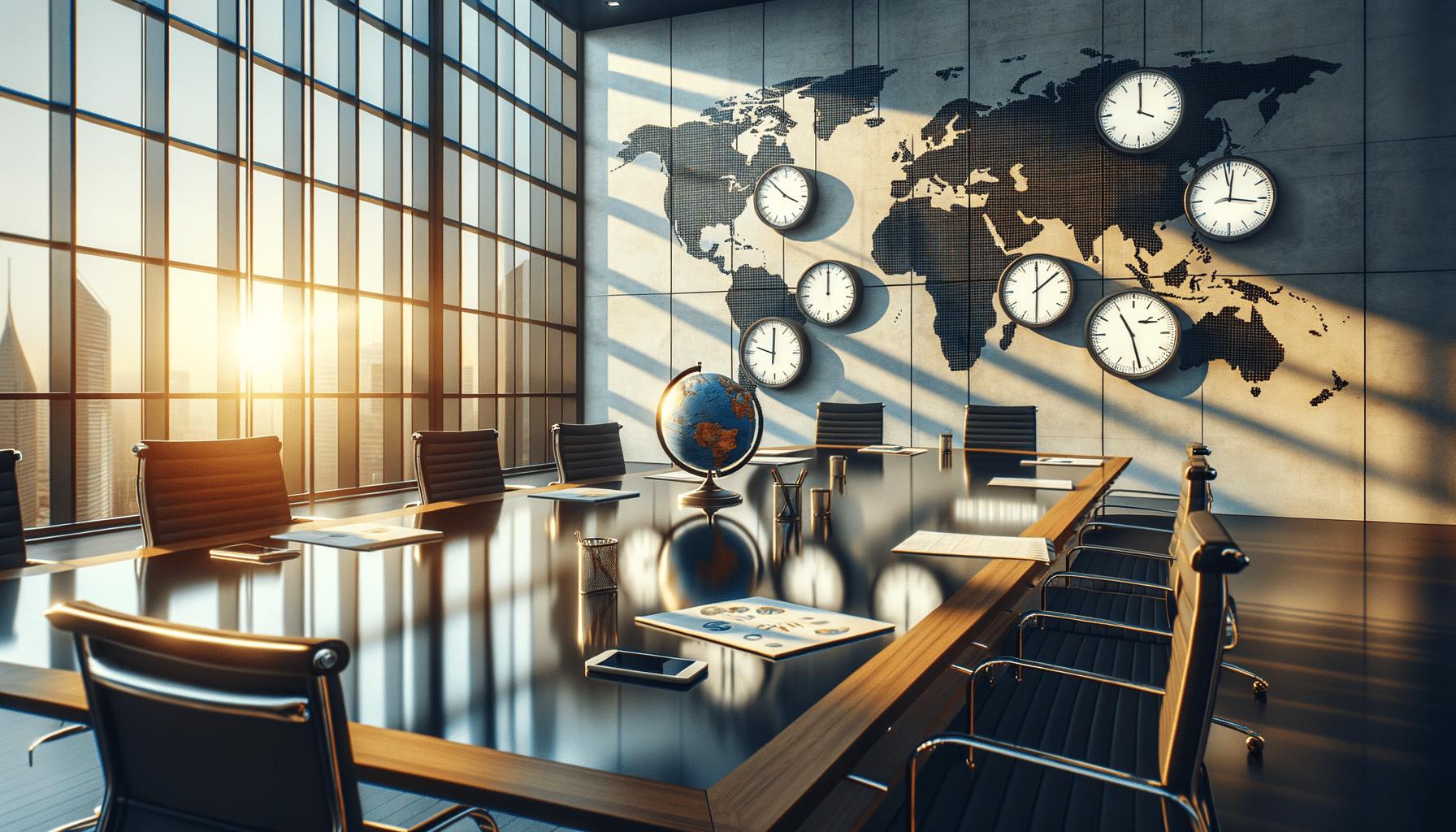

Challenges in Managing Overseas Payroll

Managing overseas payroll services presents several challenges that businesses must address to ensure smooth operations. One of the primary difficulties is navigating the diverse regulatory landscape across different countries. Each nation has its own set of labor laws, tax codes, and reporting requirements, which can be daunting for companies operating in multiple regions.

Some common challenges include:

- Understanding and complying with local tax obligations.

- Managing currency fluctuations and exchange rate risks.

- Ensuring timely and accurate payroll processing across time zones.

- Addressing cultural differences in employee compensation expectations.

Addressing these challenges requires a strategic approach, often involving partnerships with local payroll experts who can provide guidance on compliance and best practices. By leveraging local expertise, companies can effectively manage overseas payrolls, ensuring both compliance and employee satisfaction.

Benefits of Outsourcing Payroll Services

Outsourcing payroll services international offers numerous benefits for businesses, particularly those with a global presence. By entrusting payroll management to specialized providers, companies can focus on their core operations while ensuring compliance with international regulations.

Key benefits of outsourcing include:

- Access to expert knowledge on global payroll regulations.

- Reduction in administrative burden and operational costs.

- Enhanced security and confidentiality of payroll data.

- Scalability to accommodate business growth and expansion.

Outsourcing also allows businesses to leverage the latest technology and industry best practices, resulting in more efficient and accurate payroll processing. This strategic decision can significantly impact a company’s bottom line, providing both cost savings and improved operational efficiency.

Conclusion: Navigating the Future of Payroll Services

As businesses continue to expand globally, understanding and effectively managing international payroll services becomes increasingly important. The complexities of operating across different jurisdictions require a nuanced approach that considers local regulations, cultural differences, and technological advancements. By leveraging technology and expert knowledge, companies can navigate these challenges and ensure smooth payroll operations worldwide.

The future of payroll services will likely see even greater integration of technology, offering more innovative solutions for managing global workforces. Businesses that embrace these advancements and invest in strategic partnerships will be well-positioned to thrive in the international marketplace.