Understanding Home and Auto Insurance Quotes: An Overview

Introduction to Home and Auto Insurance Quotes

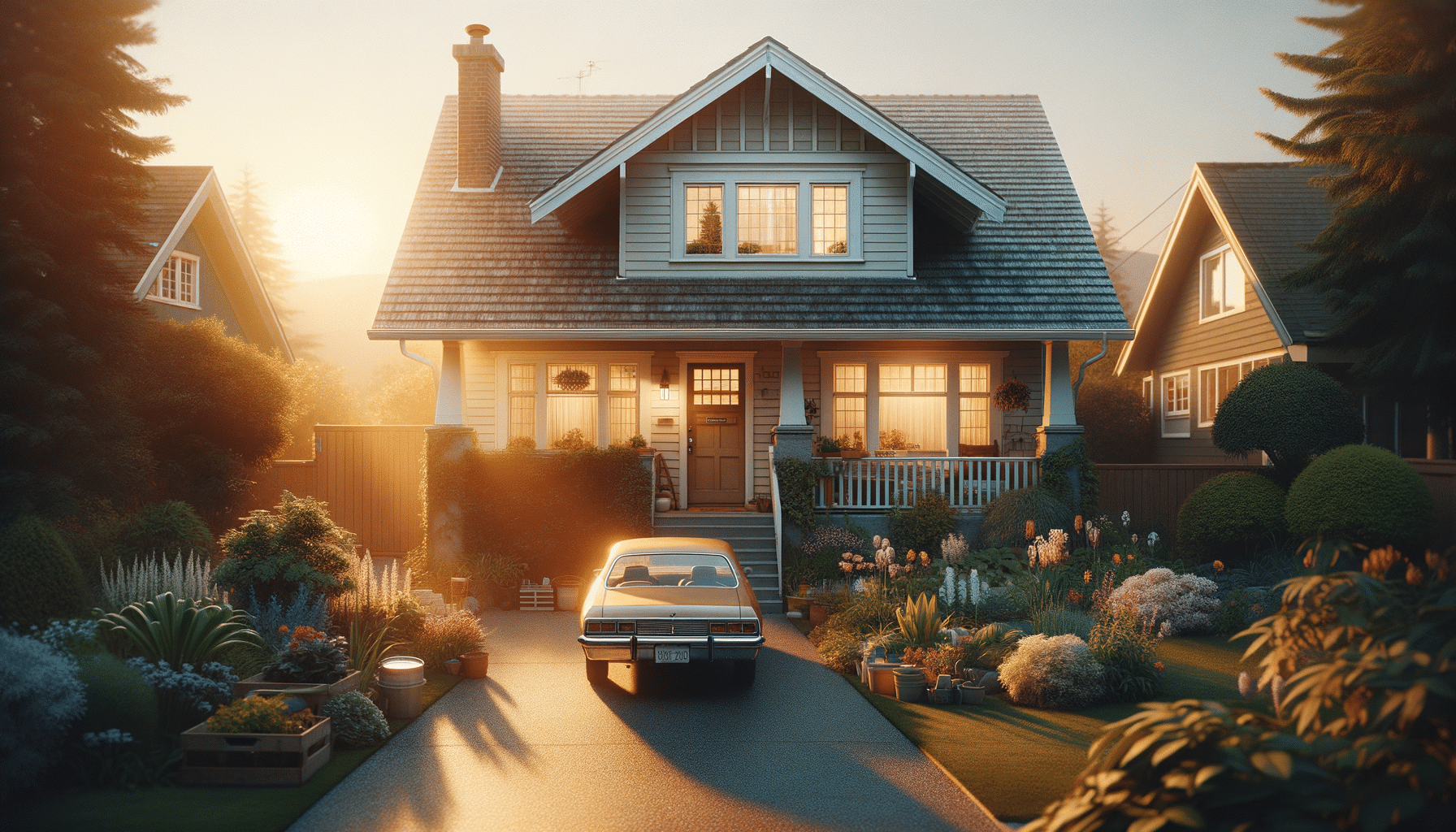

In today’s complex financial landscape, understanding the nuances of insurance is crucial for safeguarding both personal and financial assets. Home and auto insurance quotes serve as vital tools for consumers, allowing them to gauge potential costs and coverage options before committing to a policy. The terms home and auto insurance quote, online home auto insurance quotes, online home and auto insurance quotes, and home auto insurance quotes often appear in discussions among consumers seeking comprehensive coverage for their homes and vehicles. These quotes provide valuable insights into the pricing structures and benefits of various insurance policies, helping individuals make informed decisions.

By comparing different insurance quotes, consumers can identify policies that offer optimal coverage while aligning with their budgetary constraints. This process not only enhances financial security but also ensures that homeowners and drivers are adequately protected against unforeseen events. As we delve deeper into the intricacies of home and auto insurance quotes, it becomes evident that these tools are indispensable for anyone looking to secure their assets effectively.

The Importance of Home and Auto Insurance Quotes

Home and auto insurance quotes play a pivotal role in the decision-making process for anyone seeking insurance coverage. By obtaining these quotes, individuals can explore a range of options and understand the costs associated with insuring their homes and vehicles. The terms home and auto insurance quote, online home auto insurance quotes, online home and auto insurance quotes, and home auto insurance quotes are integral to this exploration, as they encapsulate the essence of comparing and evaluating insurance offers.

One of the primary benefits of obtaining insurance quotes is the ability to compare different policies side by side. This comparison allows consumers to assess the coverage limits, deductibles, and premiums associated with various insurance providers. Additionally, quotes provide a transparent view of any additional benefits or discounts that may be available, such as bundling home and auto insurance for a reduced rate.

Furthermore, insurance quotes serve as a preliminary step in understanding the financial commitment required for adequate coverage. By reviewing these estimates, individuals can budget accordingly and avoid unexpected financial burdens. This proactive approach to insurance shopping not only enhances financial stability but also instills confidence in the chosen coverage. Ultimately, home and auto insurance quotes empower consumers to make informed decisions that align with their unique needs and circumstances.

Factors Influencing Home and Auto Insurance Quotes

Several factors influence the pricing and availability of home and auto insurance quotes. Understanding these factors can help consumers navigate the complexities of insurance pricing and select policies that offer the best value. The terms home and auto insurance quote, online home auto insurance quotes, online home and auto insurance quotes, and home auto insurance quotes often reflect these considerations, which include:

- Location: The geographic location of a home or vehicle significantly impacts insurance quotes. Areas prone to natural disasters or with high crime rates may result in higher premiums due to the increased risk of claims.

- Coverage Limits: The extent of coverage desired also affects insurance quotes. Higher coverage limits typically lead to higher premiums, while more basic coverage may be more affordable.

- Deductibles: The deductible amount, or the out-of-pocket cost before insurance coverage kicks in, can influence quotes. Choosing a higher deductible often results in lower premiums, but it requires a greater initial expense in the event of a claim.

- Personal Factors: An individual’s credit score, driving history, and claims history can impact insurance quotes. Responsible financial and driving behaviors often lead to more favorable quotes.

By understanding these factors, consumers can better anticipate the costs associated with their insurance needs and strategize accordingly. This knowledge is key to obtaining accurate and competitive home and auto insurance quotes that meet personal and financial objectives.

How to Obtain Home and Auto Insurance Quotes

Obtaining home and auto insurance quotes is a straightforward process that can be accomplished through various channels. The terms home and auto insurance quote, online home auto insurance quotes, online home and auto insurance quotes, and home auto insurance quotes frequently highlight the convenience of digital platforms in acquiring these estimates.

One of the most accessible methods for obtaining insurance quotes is through online comparison tools. These platforms allow users to input their information once and receive multiple quotes from different insurance providers. This approach not only saves time but also provides a comprehensive view of available options. Additionally, many insurance companies offer online portals where consumers can request quotes directly, tailoring the process to their specific needs.

Alternatively, individuals can work with insurance agents or brokers who specialize in finding suitable policies. These professionals have in-depth knowledge of the insurance market and can provide personalized recommendations based on individual requirements. By leveraging their expertise, consumers can gain insights into the intricacies of insurance policies and ensure they are adequately covered.

Regardless of the method chosen, obtaining home and auto insurance quotes is an essential step in securing reliable coverage. By exploring different options and understanding the associated costs, consumers can make informed decisions that protect their assets and provide peace of mind.

Conclusion: Navigating the World of Insurance Quotes

In conclusion, understanding and utilizing home and auto insurance quotes is crucial for anyone looking to safeguard their home and vehicle. The terms home and auto insurance quote, online home auto insurance quotes, online home and auto insurance quotes, and home auto insurance quotes capture the essence of this process, which involves comparing and evaluating potential insurance policies.

By obtaining and analyzing insurance quotes, consumers can make informed decisions that align with their financial goals and coverage needs. This proactive approach not only enhances financial security but also ensures that individuals are prepared for unexpected events. As the insurance landscape continues to evolve, staying informed and leveraging quotes effectively will remain key strategies for securing comprehensive and affordable coverage.

Ultimately, home and auto insurance quotes serve as valuable tools that empower consumers to navigate the complexities of insurance with confidence and clarity. By embracing these resources, individuals can protect their most valuable assets and enjoy peace of mind in an ever-changing world.